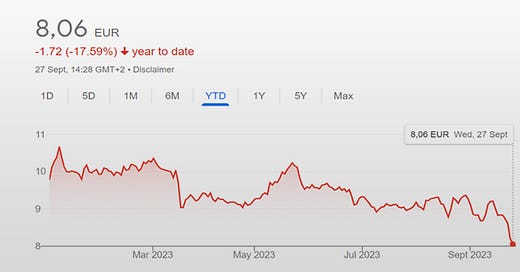

Avio's stock price takes a dive

Is there a single cause for the poor performance of the Avio stock?

Issue 72 Subscribers 2,973.

Welcome to the first Wednesday edition of the Europe in Space newsletter. This is the first of a number of strategic changes that I am going to be making to the newsletter. You can read more about those changes here.

Thank you to Latitude for sponsoring its night issue of the Europe in Space newsletter. Latitude is an innovative French launch startup developing Zephyr, a 17-metre tall launch vehicle capable of deploying 100 kg payloads to SSO at an altitude of 700 kilometres.

To my 53 new subscribers, enjoy your first issue, and, as always, if you have any comments, suggestions, or tips, you can reply to this email.

Keep reading with a 7-day free trial

Subscribe to Europe in Space to keep reading this post and get 7 days of free access to the full post archives.