Avio Soars, Satellites Slide and VCs Spend

I’m increasingly happy with the direction of the Europe in Space Market Report. The key elements are now in place, and I’ll continue refining and expanding them to deliver as much value as possible.

If you have any questions, concerns, or suggestions, please reply to this email and share your thoughts. I really love to hear as much feedback as possible to ensure the report continues to improve.

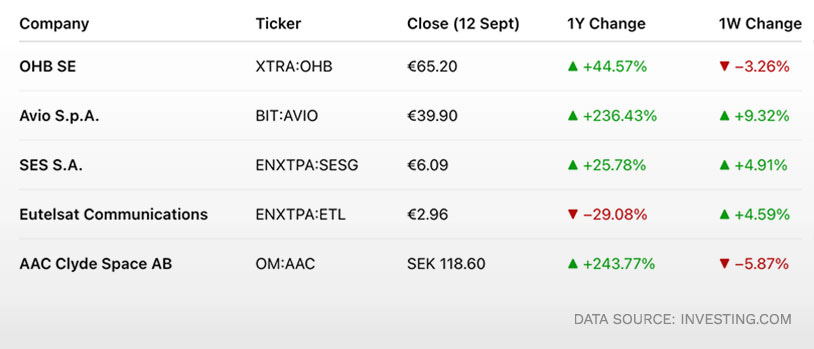

Market Pulse - 8 to 12 September

Why these companies: Europe has fewer publicly traded pure-play space companies than one might expect. As a result, most space-related indices are heavily skewed toward aircraft and defence primes, with core businesses that lie outside the space sector. While not exhaustive, this selection focuses on companies for which space is central, covering the key areas of launch, satellite operations, and satellite manufacturing.

Insight: After falling 8.86% the previous week, Eutelsat shares recovered 4.59% over the latest trading week, trimming but not erasing the prior week’s drop. The rebound coincided with several new commercial wins for the company’s geostationary (GEO) business, including multi-year capacity renewals with BHS Telecommunications and Multimedios Televisión, and a fresh distribution deal with SoFast to bring the Baywatch channel to audiences across the Middle East and North Africa. These contracts provide short-term revenue visibility, but notably, all relate to the company’s legacy GEO offering. The company’s OneWeb low-Earth-orbit (LEO) broadband business, seen as critical to its long-term future, remains absent from its recent flow of announcements. As a result, the improvement looks more like a tactical correction rather than a signal that any deeper structural challenges have been addressed.

Keep reading with a 7-day free trial

Subscribe to Europe in Space to keep reading this post and get 7 days of free access to the full post archives.